Every turn of the wheel brings unknown risks in our lives hence, having the correct auto insurance is not just a luxury but a need. Best car insurance rate comparison tool​ among the many automobile insurance plans on the market, examining the finer details can often be overwhelming. These factors could explain why many people in India get vehicle insurance without really knowing what their choice meant.

When faced with a denied claim or an unexpected disaster, the reality sinks in, leaving them scrambling to understand their coverage—or lack thereof. Car insurance comparison is truly vital, as this all-too-frequent situation shows. Comparing auto insurance policies can help you avoid the pitfalls of inadequate coverage and prevent future regrets.

People often remain vulnerable due to their ignorance about the true benefits of their automobile insurance. At Renew Buy, we want to close that gap by giving you the data required to decide wisely on the extent of your auto insurance.

What is car insurance?

The next step after finding the car of your desires is to obtain vehicle insurance from a reliable source. Consider it a safety net for your cherished vehicle and the relatives who will operate it. Also known as four-wheeler insurance, car insurance is a contract between you, the policyholder, and an insurer meant to shield you from unanticipated factors such as accidents, theft, or natural disasters. Car owners in India can choose from three categories of four-wheeler insurance: standalone own-damage insurance, third-party insurance, and comprehensive coverage.

Every automobile owner, says the Motor Vehicles Act of 1988, must at least have third-party insurance coverage. This covers you if you ever cause physical or property damage in an accident. You might also decide to level up and go for thorough insurance policies that would cover mechanical problems, damage by natural causes, or theft.

Getting auto insurance or renewing existing 4-wheeler coverage has never been easier than today. Though there are several insurance choices available online at different pricing ranges, InsuranceDekho believes in enabling you to remain protected without going bankrupt. Select from the policies listed below, or contact us to identify the four-wheeler insurance most suitable for you.

Read also: Fuel Economy Car Comparisons

Why Should One Contrast Car Insurance?

Although it may not seem significant at first, comparing auto insurance rates can be beneficial. A thorough comparison of auto insurance prices will help you save a lot of money in the long run. Here are the reasons it's worth your time:

1. Savings on Costs

Comparing car insurance is like looking for the greatest bargain on a prized item. Every insurance provider computes premiums differently depending on your driving record, vehicle type, and location. You may get the most competitive rates for your preferred level of coverage by comparing auto insurance costs from many insurers. This implies that for other crucial items, more money remains in your pocket.

2. Sufficient Coverage

Car insurance is not universal. While some drivers would want thorough coverage protecting against a wide range of dangers, others might simply need basic third-party insurance coverage. A thorough vehicle insurance comparison lets you evaluate the coverage limits, deductibles, and extra benefits each insurer provides. This guarantees you are not paying for coverage you don't need and offers sufficient protection in case of an accident, theft, or other unplanned incidents.

3. No Surprises

Should you fail to compare auto insurance policies, hidden costs, unanticipated coverage gaps, and rejected claims—these are all possibilities. Comparing auto insurance premiums up front would help you to prevent these unpleasant shocks later on. Examining the tiny print, inquiring, and knowing your policy's terms and conditions will let you choose which insurer provides the most general value and security.

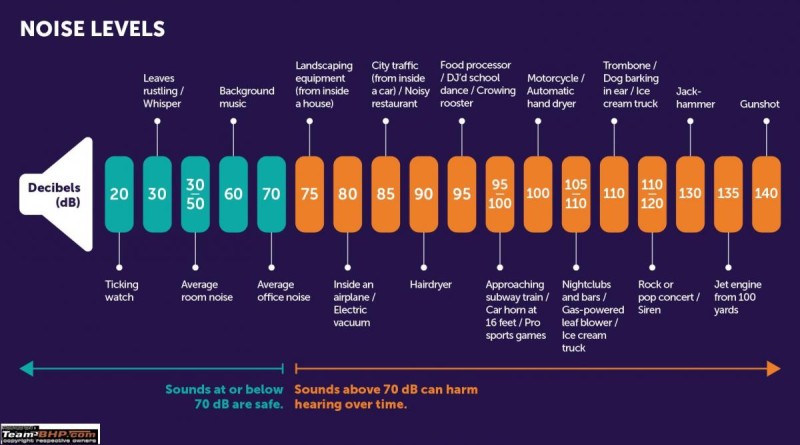

Read also: Car Interior Noise Level Comparison

Why Should You Look Online for Car Insurance comparisons?

Using online tools and platforms to compare vehicle insurance has various benefits over conventional offline approaches. Here is an explanation for your action:

1. Your Fingertips' Convenience

Online vehicle insurance comparison may be done any time, any place, unlike offline comparison techniques that call for making appointments or visiting many insurance offices in person. All you need is an Internet connection and a device to access a multitude of auto insurance choices right now, whether you are at home, at work, or on the road.

2. Real-Time Updates

By using online vehicle insurance comparison tools, you can receive real-time quotation changes, ensuring constant access to current information. Internet databases constantly update to reflect changes in price and coverage alternatives provided by insurers, unlike paper brochures or out-of-date listings.

3. Wider Selection and transparency.

Comparing vehicle insurance online provides you with access to a larger range of insurance companies and products than you would find via offline channels alone. Online tools and platforms compile data from several insurers, so they provide you with a complete picture of your choices and enable simple comparison of auto insurance prices, policy specifics, and customer feedback.

4. Time Savings

By removing the requirement for face-to-face meetings and physical records, online auto insurance comparison may also help you save precious time and resources. It is possible to quickly gather and compare quotes from multiple insurers in a fraction of the time it would take to do so offline. The results will enable you to timely make educated selections.

5. Unprejudiced Information

Comparing vehicle insurance online also gives you the benefit of getting unbiased information. Online comparison tools can offer more clear insights, unlike working with an insurer's representative who might give some products priority depending on commissions or incentives. This approach guarantees that the information you get is unbiased, so it enables you to decide only on your personal requirements and preferences.

Read also: Automotive Trends In Customer Demands

7 Factors to Weigh When Evaluating Car Insurance Policies

Selecting the appropriate balance between coverage, cost, and convenience helps one to compare car insurance; it's not only about selecting the least expensive choice. When assessing various insurance products, keep these seven important elements in mind:

1. Types and Limits of Coverage

Know the kinds of automobile insurance coverage each policy provides, including third-party or comprehensive. Find the coverage limitations and evaluate if they fit your requirements and possible hazards.

2. Deductibles

Think about the deductibles linked to every coverage type. Usually, a greater deductible leads to cheaper premiums but indicates more out-of-pocket expense in case of a claim. If an accident happens, select voluntary and mandatory deductibles you can easily afford.

3. Costs

Look at auto insurance prices offered by other companies for equivalent coverage. Search for extra advantages depending on a safe driving history, several insurance policies, car safety elements, etc. Consider any accessible reductions to obtain a precise view of the whole charge.

4. Exclusions of Policies

To find any exceptions or restrictions that could apply, read the policies' small print. Pay attention to limitations on coverage for particular kinds of cars, drivers, or accidents, as well as any conditions that can influence claim settlement.

5. Claims Procedure and Customer Service

As part of the thorough vehicle insurance comparison, investigate the reputation of each insurer for customer service and claims processing. Search for policyholder reviews to assess satisfaction. Before choosing a policy, also take into account the company's history of settling conflicts, claim-filing simplicity, and response.

6. Extra Advantages

Consider any extra perks or add-ons each insurance provides, such as 0% depreciation, roadside help, etc. When weighing choices, these additions could be worthwhile to think about, as they can enhance the policy.

7. Insurer's Financial Stability and Reputation

Select a dependable insurance with excellent financial status. Please review the financial ratings of the insurance company to ensure they are capable of promptly settling claims and fulfilling policyholder responsibilities.

Read also: All Wheel Drive Vehicle Comparisons

Conclusion on Best Car Insurance Rate Comparison Tool​

Choosing the greatest vehicle insurance premium should not be a laborious or aggravating task. A reliable tool for comparing vehicle insurance rates lets you quickly evaluate many rates side by side, learn about coverage alternatives, and find hidden discounts—all in only a few clicks. Best car insurance rate comparison tool​ these tools enable you to choose wisely depending on your budget, driving history, and coverage requirements. Using a reliable comparison tool gives you control, whether you're a first-time consumer or just wanting to change providers. It's about getting peace of mind, knowing you choose the correct coverage for you, not only about saving money. Smart drivers in the digital era don't just guess; they compare.

FAQs: Best Car Insurance Rate Comparison Tool​

What is the best price comparison site for car insurance?

Trial. Its smart quotation research tool still gives Money Saving Expert a benefit. It offers excellent rates and ideas to reduce your expenses. Contrast The market has given the lowest price back and closed the gap.

What is the best way to comparison shop for car insurance?

Working with several insurance firms, independent agents and brokers may assist you in comparison shopping. A local insurance provider in your area might provide some local choices in addition to Geico, Progressive, and State Farm.

Which car comparison site is best?

The finest automobile comparison tool, Car Dekho, lets you compare two or more vehicles of your choosing. To make a good decision for you, compare automobiles in India on several criteria like price, features, specs, fuel consumption, mileage, performance, dimensions, safety, and more.

Who is known for the cheapest car insurance?

At 30% less than the national average, USAA is the cheapest choice for full-coverage vehicle insurance. Travelers is the least expensive national vehicle insurance company for anyone not qualified for USAA coverage.

.webp)